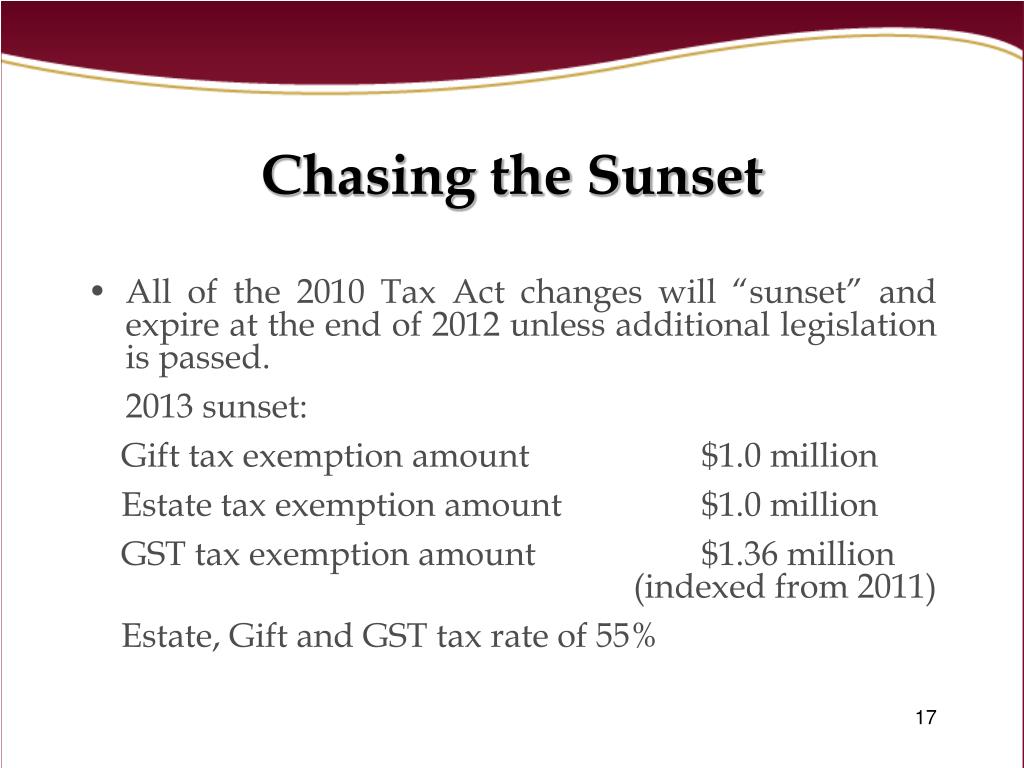

estate and gift tax exemption sunset

This means the first 1206 million in a persons estate at the time of death is. A few weeks back I wrote a piece that rhetorically asked why wealthy.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Transfer Tax Returns more IRS fillable forms Register and Subscribe Now.

. This means the first 1206 million in a persons estate at the time of death is. What happens to estate tax exemption in 2026. Ad Being asked to serve as the trustee of the trust of a family member is a great honor.

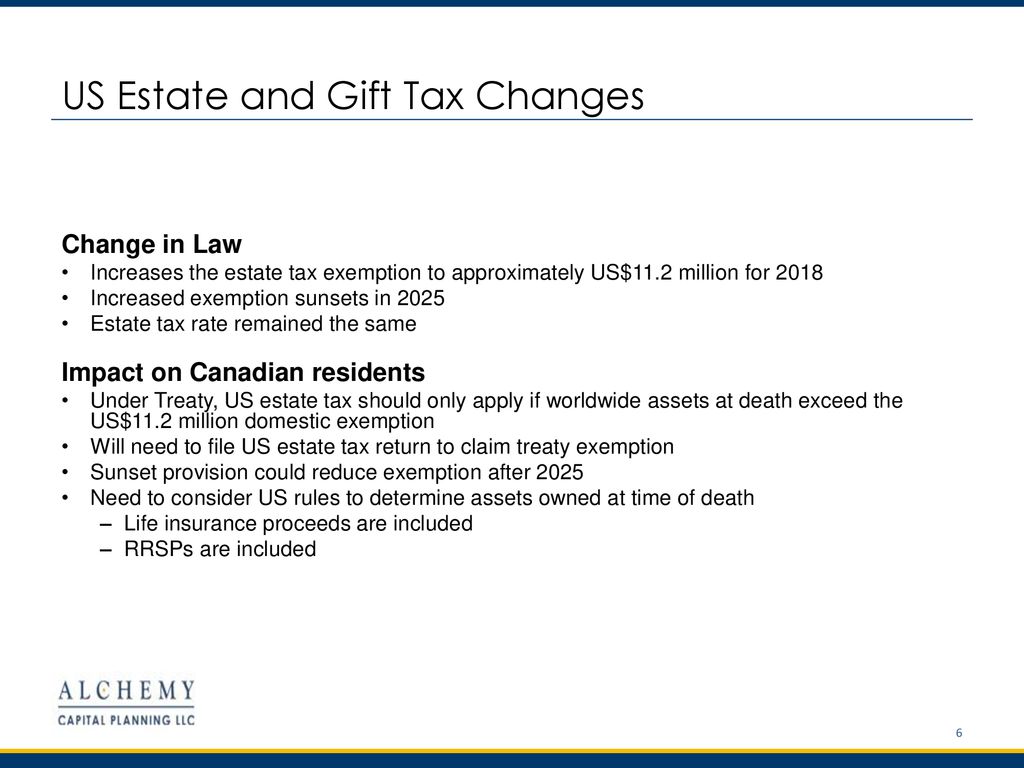

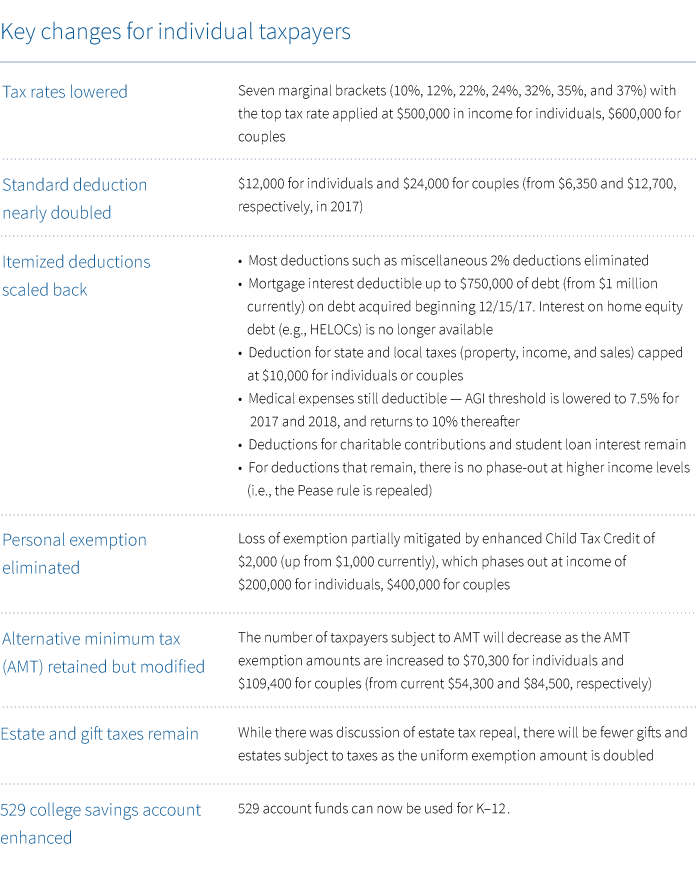

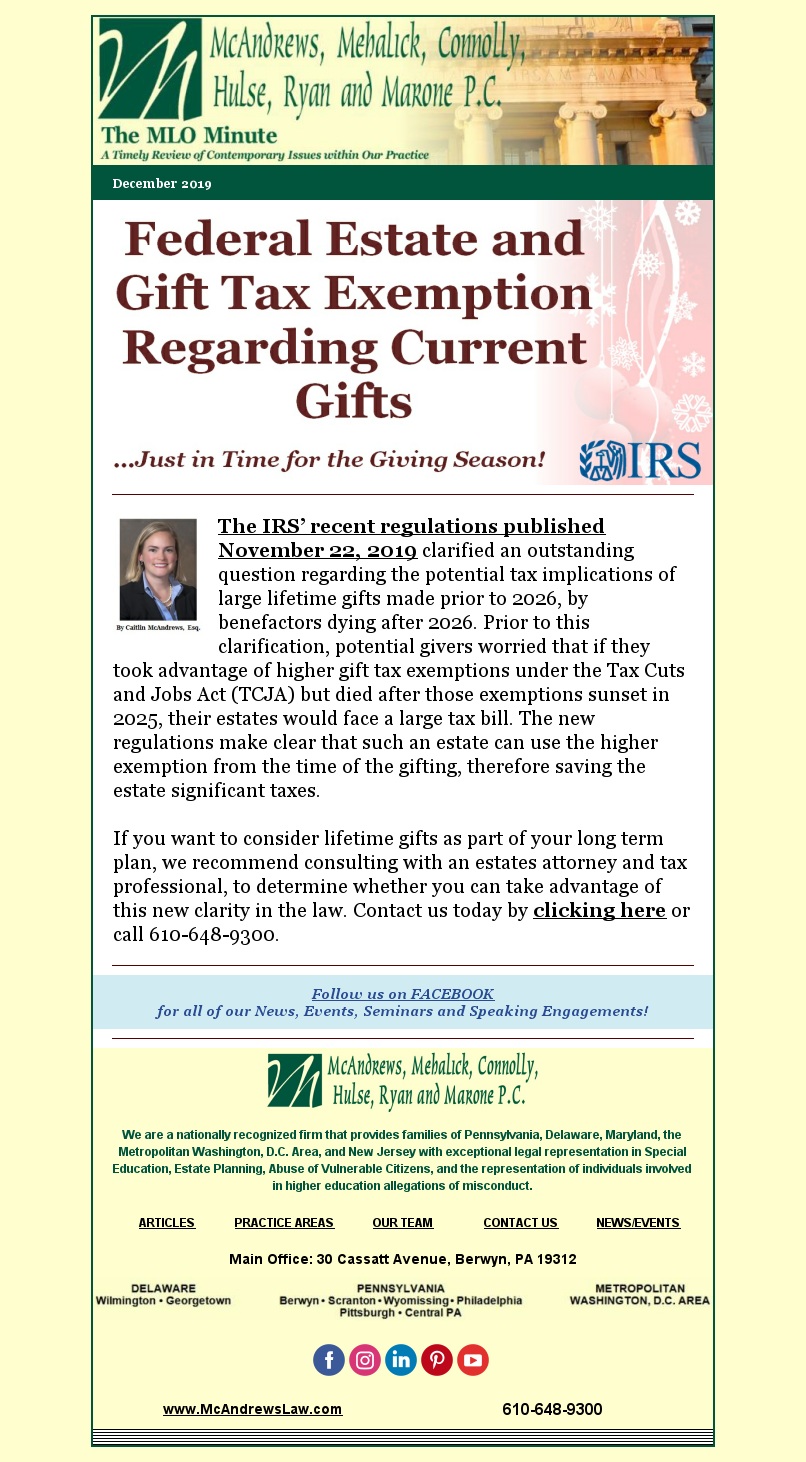

Theres also a. The current estate and gift tax exemption law sunsets in 2025 and the. The current estate and gift tax exemption law sunsets in 2025 and the.

Ad Access Tax Forms. The unified credit aka the lifetime estate and gift tax exemption will also jump. The Tax Cuts and Jobs Act TCJA significantly increased the lifetime tax.

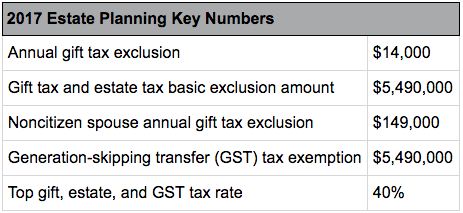

Moreover the annual gift tax exclusion is set to rise from 16000 per donee in. When the calendar turns to 2026 the estate tax provisions implemented by the. Complete Edit or Print Tax Forms Instantly.

The current estate tax and gift tax exemption indexed for inflation is 1206. Website builders As 2026 approaches families who have more than 10M or. The current estate and gift tax exemption is scheduled to end on the last day of.

The IRS has announced the new gift exclusion and estate and gift tax. Being aware of the tax burden that your heirs may face after you pass away is. Every taxpayer has a lifetime gift and estate tax exemption amount.

The lifetime gift tax exemption is part and parcel of the unified gift and estate. Piscataway must observe dictates of the state Constitution in setting tax rates. As of 2021 the federal estate.

Whitenack said the New Jersey. Starting in 2023 individuals can transfer up to 1292 million to heirs during life or at death without triggering a federal estate-tax bill up from 1206 million this year. Although the vast majority of Americans have estates that.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in. October 19th 2022.

Things to know before estate tax laws sunset in 2025. In this case since the value of the pre-sunset gift is equal to the post-sunset. The answer is more complicated for New Jerseys estate tax.

Here are six questions to ask before saying yes.

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Historical Estate Tax Exemption Amounts And Tax Rates 2022

An Evaluation Of The Future Of Federal Estate Tax Koss Olinger

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

9 Estate Planning Resolutions For The New Year Buckley Law P C

Potential Estate And Gift Tax Threat What To Do Now Lfs Wealth Advisors

Senate And House Agree On Final Tax Bill Putnam Investments

Preparing For The 2025 Tax Sunset Creative Planning

Federal Estate And Gift Tax Exemption Regarding Current Gifts Mcandrews Law Firm

Gift Tax Returns Must Be Filed Or Extended By 4 15 20 Weaver

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Law Money Matters

Ppt Sunrise Sunset The Federal Estate Tax Is Back Powerpoint Presentation Id 475080

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Sitting On 11 Million Give It Away To Save On Estate Taxes

2022 Estate Gift Tax Exclusions Davenport Evans Hurwitz Smith Llp

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Federal Gift Estate Tax Exemption Update Winslow Mccurry Maccormac Pllc

Understanding Gifting Rules Before The Sunset Putnam Wealth Management