irvine ca income tax rate

Demands for a living wage that is fair to workers. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075.

Cost of Living Indexes.

. The minimum combined 2022 sales tax rate for Irvine California is. Median household income in California. 175 lower than the maximum sales tax in CA.

We have info about recent selling dates and prices property transfers and the top-rated. Tax Jurisdiction Average Rate Min Rate Max Rate. Orange County Sales Tax.

This is the total of state county and city sales tax rates. East Irvine Irvine 7750. The federal minimum wage is 725 per hour while Californias state law sets the minimum wage rate at 15 per hour in 2022.

10 rows Sales Tax. - Tax Rates can have a. 30 rows - The Income Tax Rate for Irvine is 93.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. The 775 sales tax rate in Irvine consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax.

California state offers tax deductions and credits to reduce your tax liability including a. Realistic real estate value appreciation will not increase your yearly bill sufficiently to justify a. California income tax rate.

Taxes in Irvine California are 102 more expensive than Brea California. The US average is 46. What is the sales tax rate in Irvine California.

Irvine City Sales Tax. Carefully calculate your actual property tax including any exemptions that you are allowed to have. Census Bureau Number of cities that have local income taxes.

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

Income Tax Preparation Chicago Accounting Services Of High Quality That Can Help You Handle Even The Most C Income Tax Preparation Tax Preparation Tax Attorney

California Paycheck Calculator Smartasset

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Ways To Save On Home Expenses Money Savvy Ways To Save Money Mindset

Non Prime Financing 500 Fico 1 Day Out Of Bankruptcy Foreclosure Or Short Sale Bank Statement Program Availab Commercial Loans Usda Loan Mortgage Companies

Multiple Property Financing Commercial Loans Mortgage Companies Usda Loan

Tax Rates And Income Brackets For 2020

1 Year Tax Returns For Self Employed Always At Your Service Jasmen Vartanian President Broker Tel Mortgage Payoff Mortgage Loan Originator Tax Return

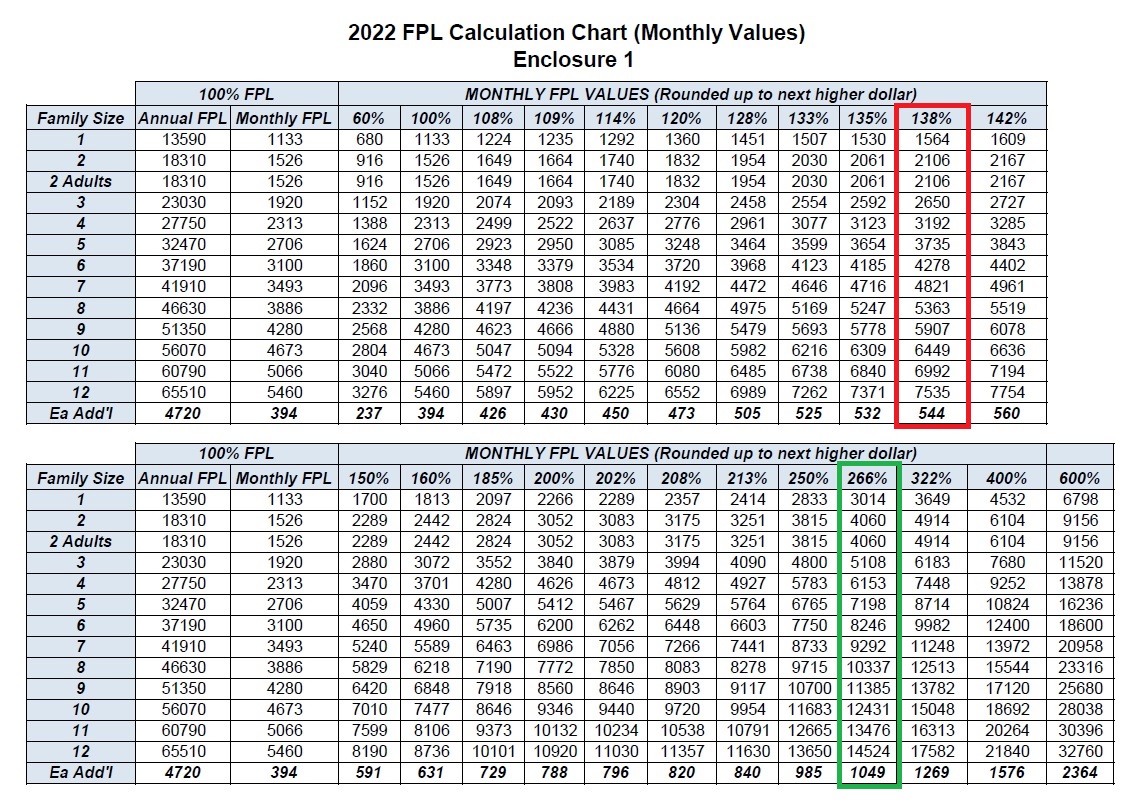

Big Increase For The 2022 Medi Cal Income Amounts

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

Pin On Accounting Bookkeeping Services

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form